สวัสดีคอแทงหวย ที่หวังรวยทุกท่าน ยินดีต้อนรับทุกท่าน เข้าสู่ เว็บแทงหวยออนไลน์ 999LUCKY158

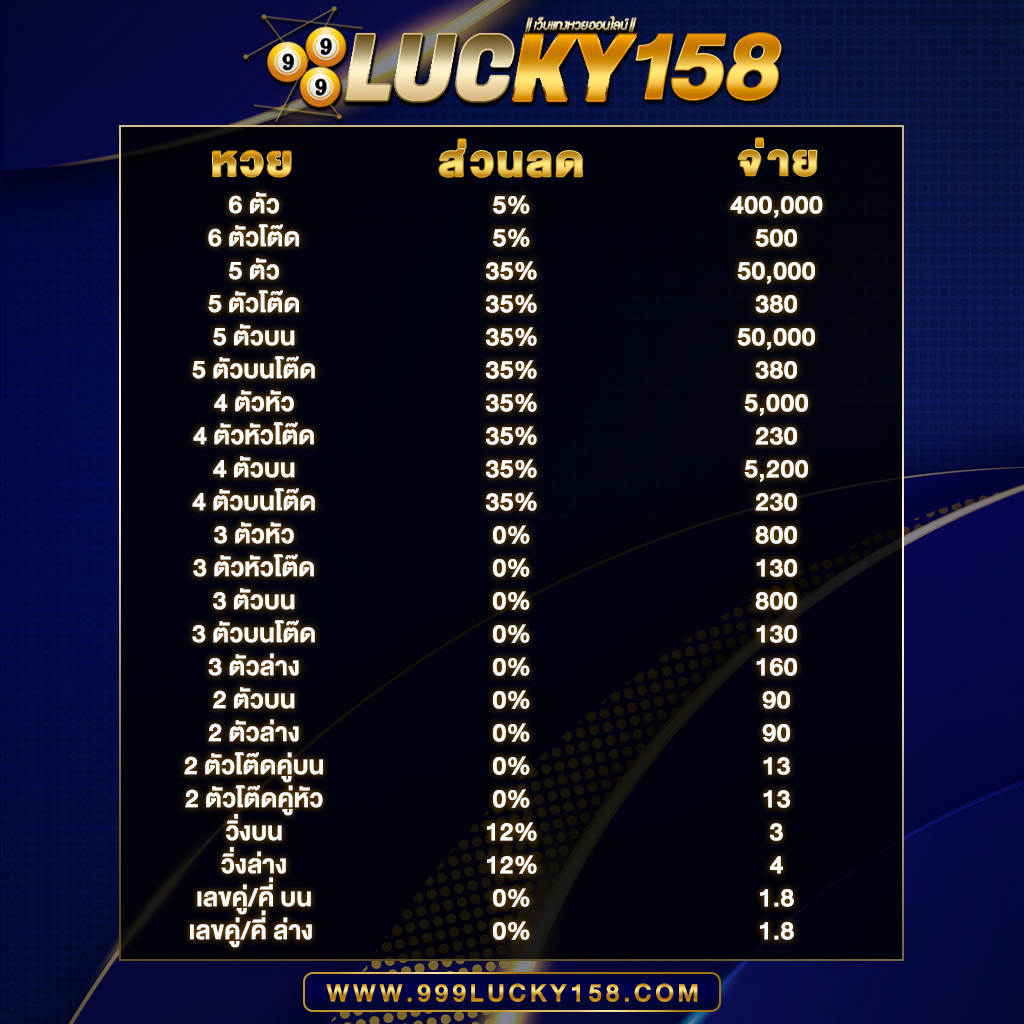

เว็บแทงหวยที่จ่ายแรงที่สุดในยุคนี้ เล่นง่าย จ่ายจริง อัตราการจ่ายรางวัลสูงที่สุดในไทย

สวัสดีคอแทงหวย ที่หวังจะรวยทุกท่าน ยินดีต้อนรับทุกท่าน เข้าสู่ระบบ เว็บแทงหวยออนไลน์ 999LUCKY เว็บแทงหวยที่ได้มาตรฐานที่สุด จ่ายแรงที่สุดในยุคนี้ เพราะเว็บหวยออนไลน์ของเรา จ่ายจริง จ่ายเต็ม จ่ายหนัก ราคาดี จ่ายสูง ด้วยอัตราการจ่ายรางวัลที่สูงที่สุด ไม่เคยมีประวัติเสียด้านการเงิน แทงหวยออนไลน์ ซื้อหวยออนไลน์ 999LUCKY การเงิน มั่นคง ปลอดภัย ไว้ใจได้ 100%

999LUCKY เว็บแทงหวยออนไลน์ครบวงจร อันดับ 1 ในไทย เราเปิดบริการด้านหวยออนไลน์มายาวนานหลายปี ถือได้ว่าเว็บไซต์เราเป็นเจ้าแรกในไทย ที่นำเอาหวยทุกชนิดมารวมไว้ในเว็บเดียว ให้ทุกท่านได้เลือกเล่นกัน ไม่ว่าจะเป็นหวยในประเทศหรือหวยนอกประเทศ อาทิเช่น หวยเวียดนาม หวยรัฐบาล หวยลาว Huay Huayden หวยยี่กี หวยปิงปอง หวยมาเลย์ หวยหุ้นไทย หวยหุ้นประเทศต่างๆ และหวยลัคกี้เฮง และยังมี คาสิโนและเกมส์ออนไลน์อื่นๆ ให้คุณได้เลือกเล่นมากมาย เช่น สล็อตแมชซีน เป่ายิงฉุบ ปั่นแป่ะ เป็นต้น

แทงหวยออนไลน์ ซื้อหวยออนไลน์ 999LUCKY ฝากถอนอัตโนมัติ ฝาก-ถอนได้ตลอด 24 ชั่วโมง ฝากเงินมาปรับยอดเครดิตเร็วทันใจ โอนไว ถูกหวยได้เงินจริง ได้เงินครบ ถูกล้านจ่ายล้าน ไม่มีโกง แน่นอนครับ เรายังรองรับการเล่นผ่านคอมพิวเตอร์และระบบเล่นผ่านมือถือ ไม่ว่าจะเป็นระบบ PC , Browser , Windows และ Android , IOS และทุกระบบที่มีสัญญาณอินเตอร์เน็ต สามารถเล่นกับเราได้ทุกที่ทุกเวลา สะดวกสบาย ตอบโจทย์สำหรับนักเสี่ยงโชคทั้งหลาย และเรายังมีทีมงานโปรแกรมเมอร์ระดับเทพ ทีมงานจะคอย Support ท่านตลอด 24 ซม. บริการประทับใจ ใส่ใจดูแลลูกค้าทุกท่าน ท่านจะไม่ผิดหวังอย่างแน่นอน

999LUCKY เว็บแทงหวยออนไลน์ที่มาพร้อมระบบรักษาความปลอดภัยขั้นเทพ ได้มาตรฐานระดับสากล

- ระบบรักษาความปลอดภัยระดับเทพ

- ใช้ Cloud Server เต็มรูปแบบ

- ระบบ สำรองข้อมูลลูกค้าแบบ Ail Time ไม่ต้องกลัวว่าเงินจะหาย

- ฝากถอนได้โดยไม่มีขั่นต่ำ

- มีโปรโมชั่นและสิทธิพิเศษอีกมากมาย

- แทงหวยไม่มีขั่นต่ำ

- อัตราการจ่ายสูงถึงบาทละ 800

- ระบบฝากถอนอัตโนมัติ รวดเร็ว ทันใจ

- รองรับการแทงหวยออนไลน์เต็มรูปแบบ

- ระบบติดต่อทางทีมงานเราได้ตลอด 24 ซม.

- ระบบแนะนำสมาชิก จ่ายค่าตอบแทนสูงสุดถึง 5%

- หวยปิงปอง ออกผลด้วยตัวเองได้

มาพูดถึง ระบบรักษาความปลอดภัยของ 999LUCKY

- ข้อมูลส่วนตัวและข้อมูลบัญชีของท่านจะถูกปิดบังไว้เป็นความลับเพื่อความปลอดภัยของท่าน

- ความปลอดภัยจากทางบริษัทเราใช้ระบบรักษาความปลอดภัยที่มีสเถียรภาพที่สูง มั่นใจได้ เราจะรักษาความปลอดภัยของท่านไว้อย่างดีแน่นอน

- บริาัทเราเปิดบริการมายาวนานหลายปี จึงมีความน่าเชื่อถือสูง ทำให้ลูกค้าทุกท่านมั่นใจอบอุ่นทุกครั้งที่เข้ามาใช้บริการ

- หากท่านพบเจอปัญหาหรือข้อสวสัย สามารถติดต่อ ฝ่ายบริการลูกค้า ได้ตลอด 24 ซม. แล้วท่านจะคำตอบที่ดีที่สุดจากเรา

- การเงิน ของท่านจะ มั่นคง ปลอดภัยแน่นอน ถ้าเลือกเล่นเว็บหวยออนไลน์ กับ 999LUCKY เว็บหวยออนไลน์ที่ดีที่สุดในประเทศไทย

หวยออนไลน์ครบวงจรที่เดียว ในประเทศไทย ศูนย์รวมหวยทุกชนิด และเกมส์อื่นๆ อีกมากมาย

- หวยรัฐบาลไทย

- หวยล็อตเตอรี่

- หวยเวียดนาม

- หวยมาเลย์

- หวยปิงปอง

- หวยลาว

- หวยลัคกี้เฮง

- หวยหุ้นไทย

- หวยหุ้นต่างประเทศ

- หวยหุ้นดาวโจนส์

- หวยใต้ดิน

- สล๊อตแมชซีน

- เป่ายิงฉุบ

- ปั่นแป่ะ

” สมัครแทงหวยออนไลน์ได้ที่ 999lucky.co “

ข้อดีในการแทงหวยออนไลน์กับเว็บไซต์เรา

- การเงินท่านจะมั่นคงและปลอดภัย กว่าที่ใดๆ

- เปิดบริการให้เล่นกันยาวๆ ตลอด 24 ซม. ไม่มีปิด

- ซื้อหวยออนไลน์ จ่ายไม่อั้น รับทุกตัว ที่นี้ที่เดียว

- มีทีมงานคุณภาพสูง ที่มากไปด้วยประสบการณคอยดูแลคุณ

- 999LUCKY เว็บเรา ซื่อสัตย์ โปร่งใส่ มั่นใจได้ถ้าเลือกซื้อหวยกับเรา

- ตราจ่ายเยอะที่สุด สูงกว่าเว็บไหนๆ

- แทงเท่าไหร่ ถูกเท่านั้น หลักร้อยหรือหลักล้านเราก็พร้อมจ่าย

- จ่ายจริง จ่ายเต็ม ไม่เคยมีประวัติการโกงมาก่อน ไม่อาเปรียบท่านอย่างแน่นอน

- เว็บเราไม่มีวันหยุดให้บริการ สามารถติดต่อสอบถามเราได้ตลอด 24 ซม.

- มีโปรโมชั่นและโบนัสแจกมากมาย และสิทธิพิเศษอีกมากมาย

999LUCKY เว็บหวยออนไลน์ ฝากถอนไวที่สุด ฝาก-ถอนได้ตลอด 24 ชั่วโมง

สมัครสมาชิก 999LUCKY พร้อมรับโปรโมชั่นและโบนัสพิเศษ และยังมีสิทธิพิเศษ ให้ท่านอีกมากมาย

เว็บพนันหวยอันดับ 1 มีหวยออนไลน์ครบวงจรทุกชนิด หวยฮานอย หวยรัฐบาล หวยลาว หวยยี่กี หวยหุ้น

ติดต่อทีมงาน 999LUCKY / บริการงานโดย เฮียบิ๊ก @ ปอตเปต

หากท่านมีปัญหาไม่สามารถเข้าหน้าเว็บไซต์ได้ สามารถติดต่อทีมงานเราได้ที่ e-mail ตลอด24ชั่วโมง

E-Mail : [email protected]

ระบบจะจัดส่งให้ภายในเวลา 2-3 นาทีโดยอัตโนมัติ